About us

DeepNFTValue is the leading valuation service for NFT pricing.

Our models use machine learning to accurately estimate the value of NFTs from blue chip collections, first launched for CryptoPunks and now expanded to Bored Ape Yacht Club, Azuki, Pudgy Penguins, Art Blocks and more.

Our models take into account more than just the floor price of a trait or collection, training neural networks with dozens of different historical data points and on-chain info. Our team brings expertise from several different machine learning backgrounds, including quantitative trading, genomics, professional poker and baseball analytics.

Contact

For media inquiries, email press@deepnftvalue.com

For partnerships opportunities, email partnerships@deepnftvalue.com

Who we serve

Our price estimates serve the greater NFT community, from services like marketplaces and lending platforms to individual collectors and research teams.

As NFTs rise in popularity, so do their use cases. And yet, there are few services built to accurately assess their value. Using our API, marketplaces can integrate DeepNFTValue price estimates directly into their interface to provide buyers and sellers with more information about the assets they’re trading. This type of data is beneficial to both the casual NFT collector and professional trader, adding a layer of transparency to an industry that can be otherwise filled with misinformation.

For lending platforms, it’s crucial that loan terms are administered based on accurate information about the underlying assets. If a loan is under-collateralized and the value of the assets depreciates unexpectedly, it can lead to forced liquidations. Our pricing model takes into account risk and price volatility, basing prices largely by their liquidity.

Causal NFT collectors, too, are beneficiaries of our services. Our leaderboard pulls on-chain data to provide real-time rankings for top collections, providing an otherwise undelivered service to audiences that enjoy the intricacies of specific collections.

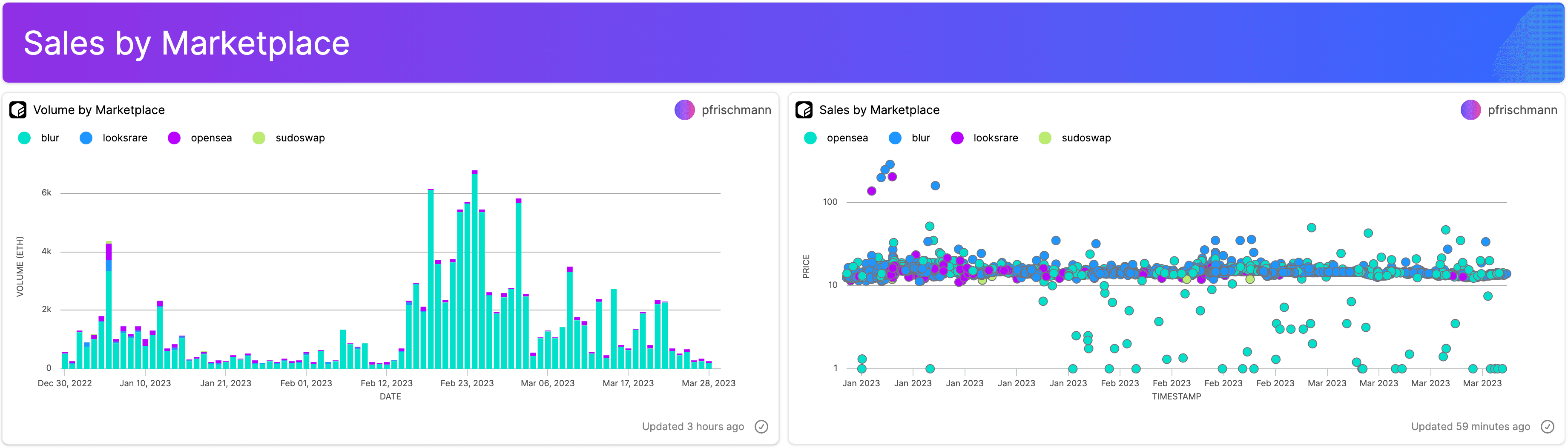

Our models can also be used to inform NFT-related research teams, particularly in media. Our price estimates are currently used by organizations pulling data to build visuals analyzing the NFT space. You can check out our integration with Flipside here.

Interested in integrating our valuations into your own application, platform, website or service? You can view our API here, or reach out to us about partnerships by emailing partnerships@deepnftvalue.com.

Why it matters

Valuing assets in real-time is difficult, time-consuming and requires a certain technical expertise. We do the math, so you don't have to.

For platforms, the ability to ingest our NFT valuations via API can unlock a variety of features and use-cases on your own site or service to improve the experience of your users. Additionally, DeepNFTValue estimates are consistently the most accurate of any pricing model, which is why we have the highest usage rates of any NFT valuation service in the industry.

To keep up with our business, follow our Twitter bot for updates on recent sales and NFT discounts.

FAQ

Why are some estimates more accurate than others?

In short, the more data we get, the more accurate the models become. Not all NFTs, especially those with increased rarity, have depths of historical pricing data. Like the physical art or vintage car market, the value of an NFT also has a degree of subjectivity, ultimately only worth what a buyer is willing to pay.

How do you choose which collections to build models for?

We choose to build models for collections that are both popular and have an adequate data set of historical sales. Our current focus is on Ethereum-based collections, but our models can be trained for other blockchains as well.